Another core concept introduced by ICT is that the market is always seeking to balance the buy side and sell side within any price range on the chart.

The term buy side is used to describe only the buying or bullish (up) movement. Price is moving in a single direction without a counter bearish (down) move. Similarly, the term sell side refers to the selling or bearish (down) movement side of price action.

For a price range to be considered balanced, the market must offer both buy and sell sides. If only one side is offered at any given price range, then it is considered imbalanced, and it is expected that the market will seek to return to that price range to rebalance it.

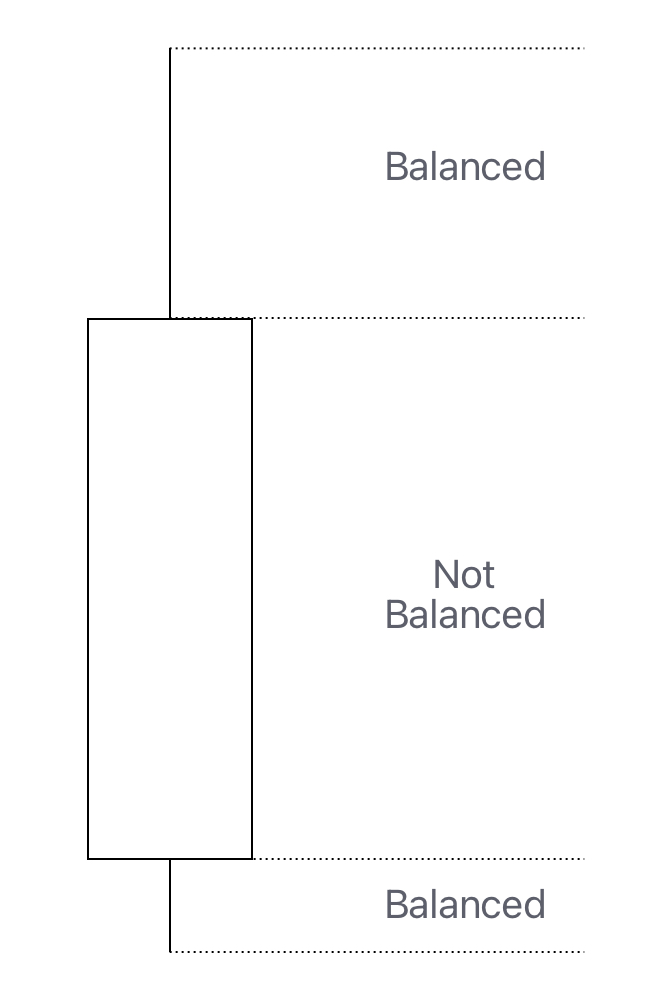

Every individual candlestick contains both balanced and imbalanced price ranges. For example, when examining a bullish (up) candle, the wicks are considered a balanced price range because a wick offered both buying and selling, whereas the body of the candle is imbalanced because it only offered the buy side.

How Price Ranges Balance

If the market is always seeking to balance price ranges then when a news event triggers a rapid rally or sell-off, leaving behind price range imbalances, what are known as Fair Value Gaps (FVG) in ICT terminology, that creates an opportunity for traders to anticipate future market movements. These gaps represent areas where the price has moved too quickly, without the usual trading activity that would fill in the price range.

In such scenarios, traders can expect one of two things to happen:

- The market may return to the area of the Fair Value Gap to ‘fill’ it, either partially or completely, as part of its natural tendency to rebalance. This is often seen when the initial news impact fades and the market reassesses the value at those price levels.

- Alternatively, the market might await a reversal or a change in the overall trend direction. When this occurs, the price will naturally pass through the previously unbalanced price points, effectively rebalancing them as part of the broader market shift.

How to spot balanced and imbalanced Ranges

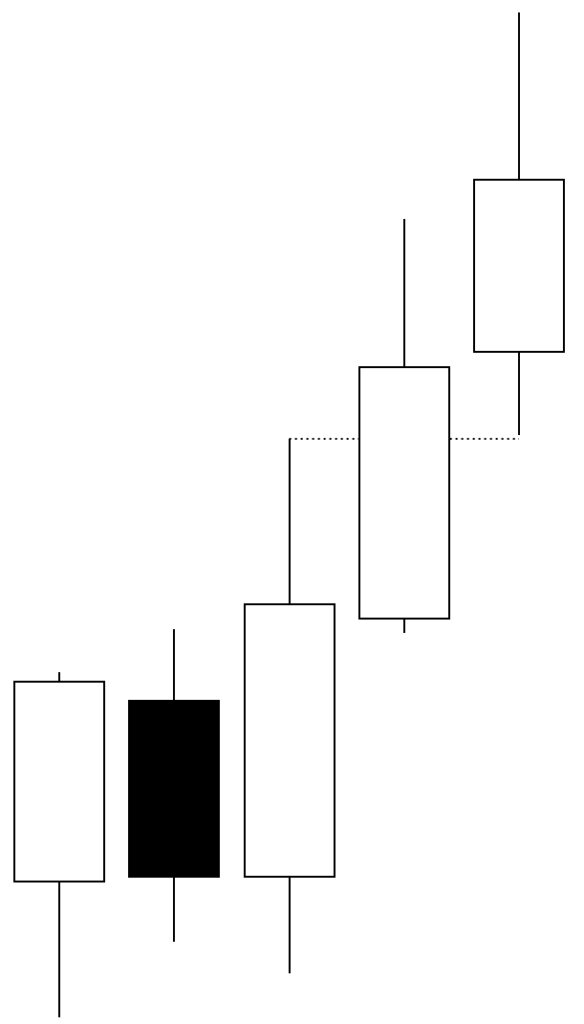

In a trending price range where price is moving higher or lower, the market typically keeps price ranges balanced by revisiting every price point at least once before resuming the trend. Sometimes, the move is strong enough that it creates a Fair Value Gap.

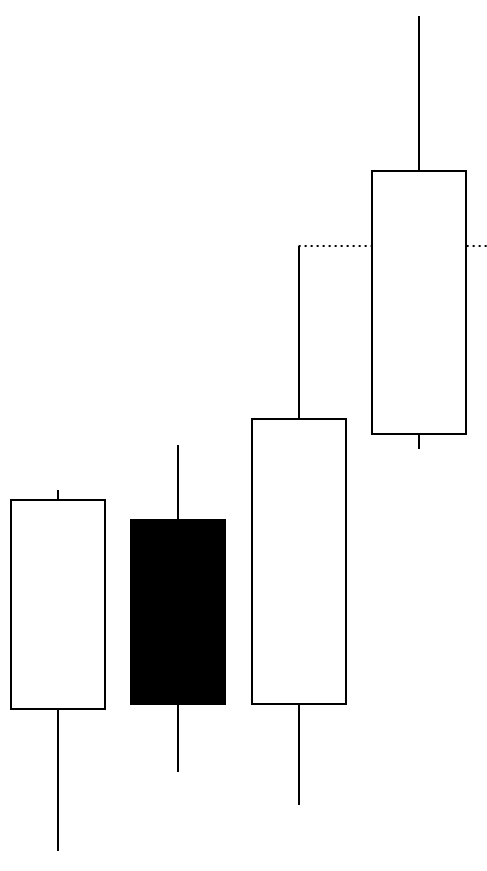

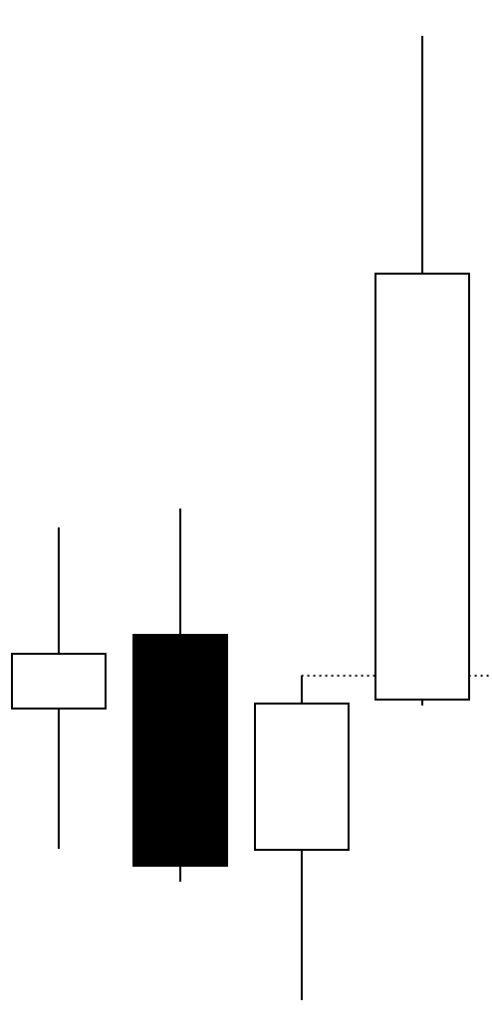

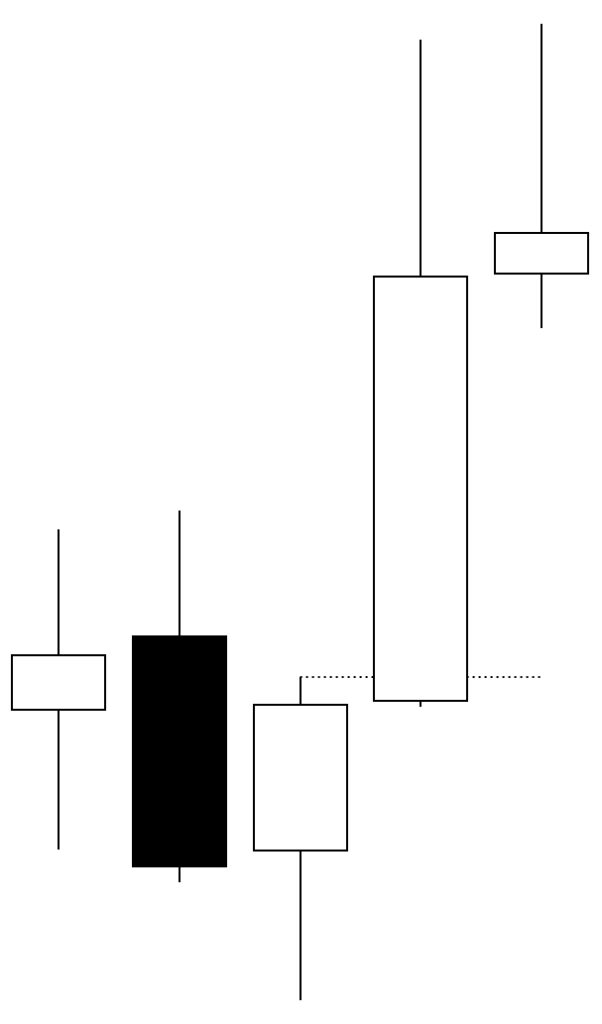

Traders aiming to identify these patterns should train their eyes at looking at candlesticks in sets of three, examining them in sequential order. Begin by analyzing an individual candlestick, then compare the high and low of the candle before it and after it. If the high and low points of these two candles overlap or meet, the price range is considered balanced. If there is no overlap, a Fair Value Gap (FVG) exists, measured by the distance between the non-overlapping high and low points. This technique is essential for traders to master, as it can reveal potential market movements and areas of interest.

How To Use Balanced and Imbalanced Price Ranges in Trading

Understanding that the market constantly seeks to balance price ranges, traders can integrate this insight with Candlestick Fundamentals across different timeframes to determine the next most probable price movement. For instance, if yesterday’s daily candle closed near the high of the previous day’s candle, it is highly likely that today’s candle will, at the very least, move lower to attempt to close that imbalance.

The pressing question is whether the market will attempt to rebalance the buy side imbalance and continue to higher, or if it will reverse and proceed lower. An imbalance or a Fair Value Gap (FVG) alone does not provide a definitive answer to this question, and traders should not solely rely on this logic for their trading decisions.

Traders must take into account the overall market structure and assess the most probable direction of the market, considering both the higher timeframe structures and imbalances, as well as those on the lower timeframes.

On the other hand, If yesterday’s daily candle closed significantly higher than the previous day’s, it is highly probable that today’s market activity will not close that gap, thereby forming a Fair Value Gap.

Traders should recall that price action is fractal in nature. The example above, although provided in the context of the daily timeframe, is applicable across all timeframes. Savvy traders can predict daily price movements by analyzing the monthly chart. However, it’s crucial to acknowledge that the market might not seek immediate rebalance and could address the imbalance at a later stage, irrespective of the gap’s magnitude.

Quick Look at Fair Value Gaps

Fair Value Gaps and Volume Imbalances require an extensive discussion. However, for a comprehensive understanding of balanced price ranges, a brief discussion is necessary.

As previously mentioned, a Fair Value Gap results from a strong market move that creates an imbalance between the buy and sell sides. ICT introduced the terms Buy-side Imbalance Sell-side Inefficiency (BISI) to denote a bullish Fair Value Gap, where the market only offered the buy side within a certain range, leading to a bullish imbalance that lacks the sell side. Conversely, Sell-side Imbalance Buy-side Inefficiency (SIBI) describes a bearish Fair Value Gap.

The mere presence of a Fair Value Gap is not a reliable basis for trading decisions, as the market may rebalance by filling the gap and reversing, or by continuing right through it. For a rebalance to occur, the market simply needs to offer the missing buy or sell side. Nevertheless, Fair Value Gaps can still be strategically utilized to frame a trade.

Using Fair Value Gap When Market Structure Shifts

After the market has reached a higher timeframe level and reversed, resulting in a market structure shift (see Candlestick Fundamentals), traders can look for the presence of Fair Value Gaps as both an indication of market reversal strength as well as a spot to place a trade on.

A Fair Value Gap indicates that the market is in a hurry to move away from that level, giving a trade setup additional confirmation. Knowing that the market will most likely wants to seek to rebalance all or part of that imbalance, traders can avoid chasing and picking random spots to place a trade entry. Instead, they can wait for the market to revisit that Fair Value Gap to join the move higher.

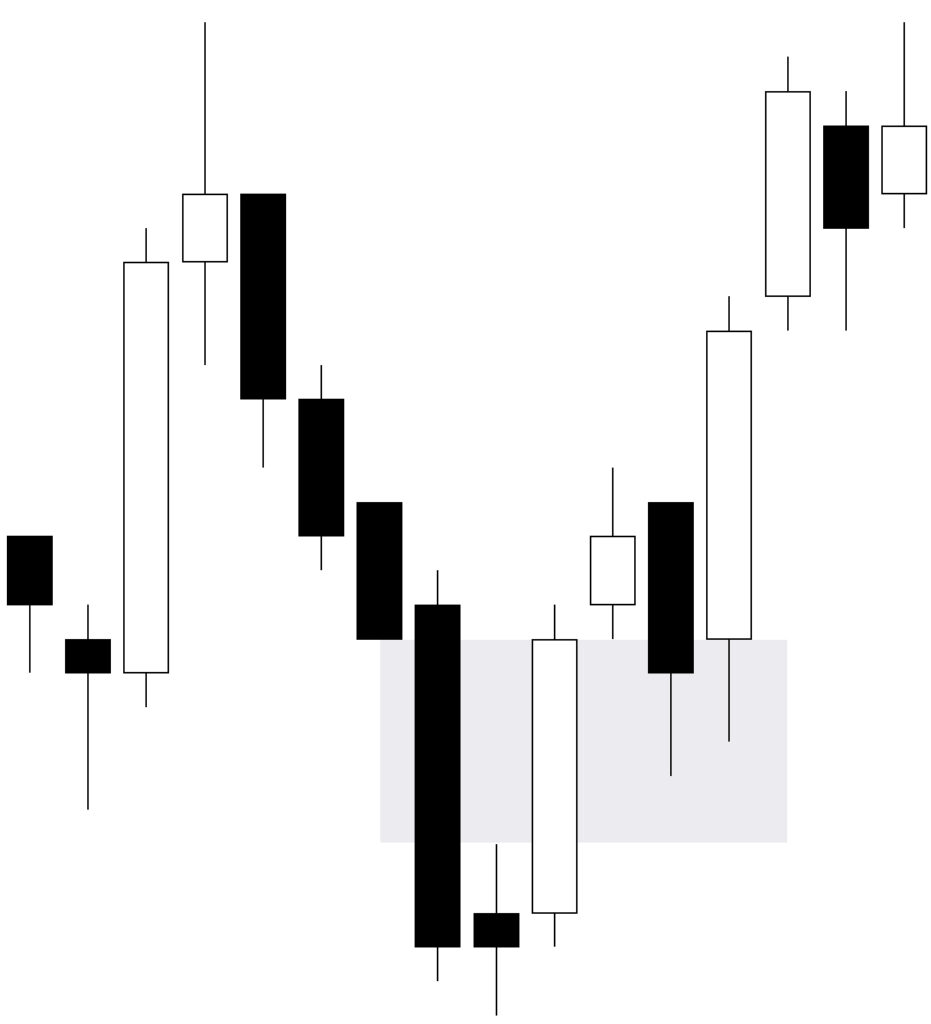

Overlapping Fair Value Gaps

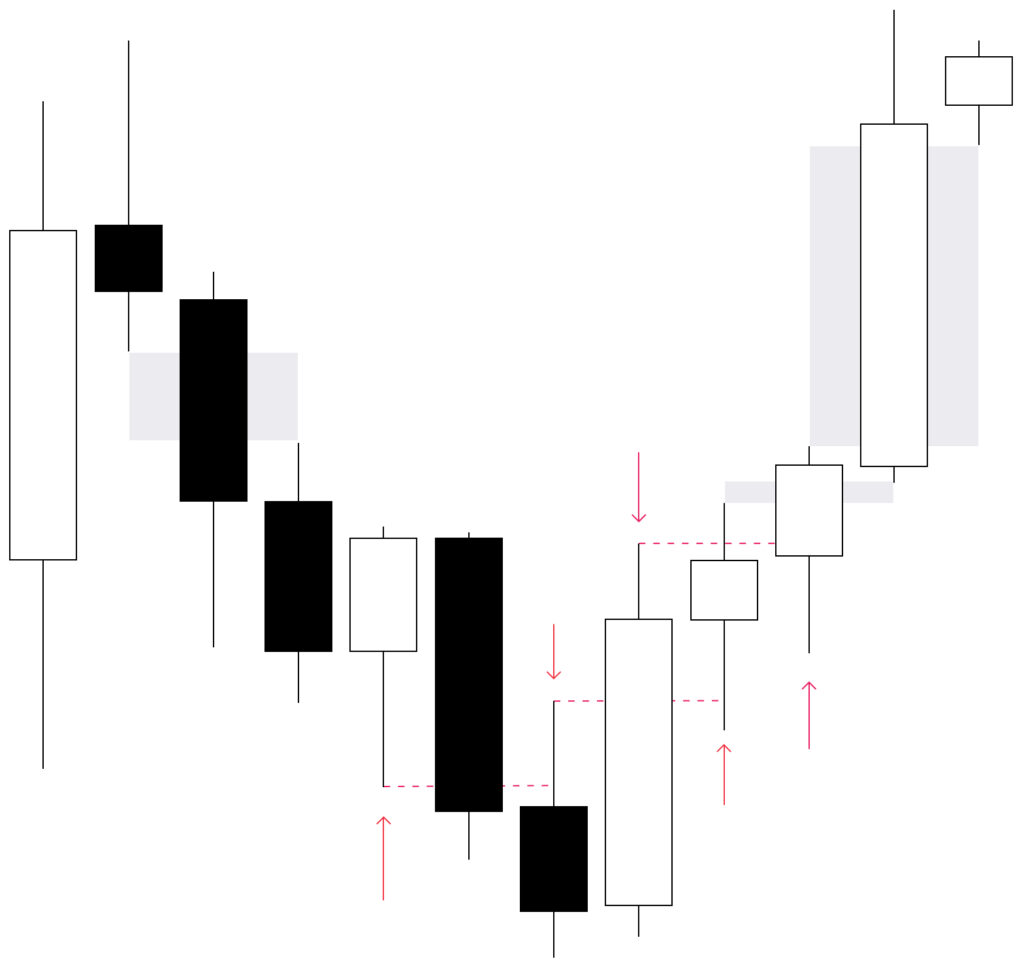

There are instances when the market may make strong move in one direction, leading to the formation of a Fair Value Gap until a key level is reached. Subsequently, the market may reverse, creating an overlapping Fair Value Gap in the opposite direction.

These overlapping gaps are viewed as strong indication of a possible reversal, as the market not only balanced a previous imbalance, it created a new imbalance in the opposite direction.

Note: Some online content and educators teach that Balanced Price Range (BPR) refers only to overlapping Fair Value Gaps. This interpretation stems from the initial introduction of the BPR concept by ICT, he used this example prominently. Consequently, early content creators and educators assumed that the term was applicable exclusively to such setups.